27+ What can we borrow mortgage

We can see from your bank. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

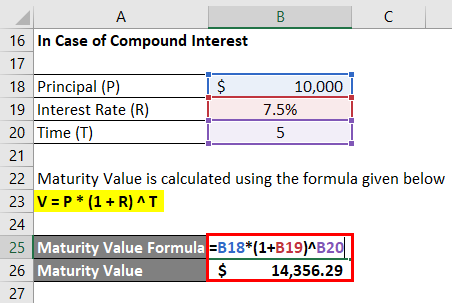

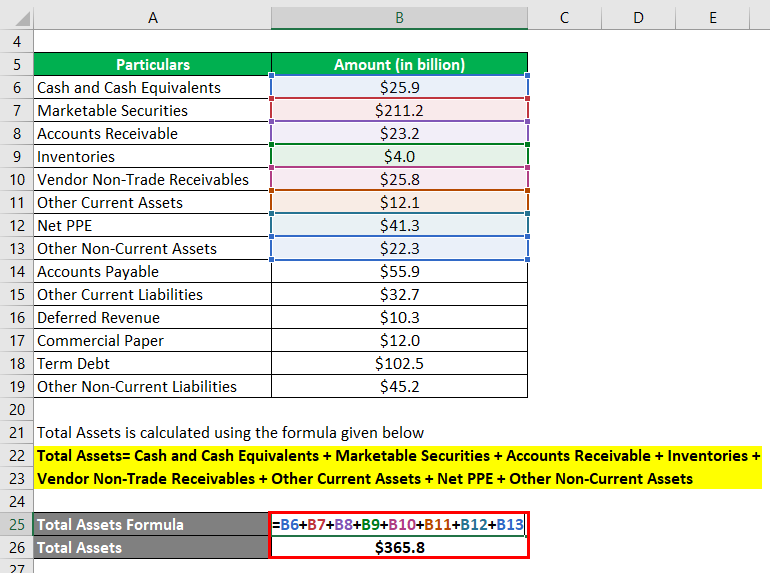

Maturity Value Formula Calculator Excel Template

I spend about 2500 per month on living expenses.

. If youre concerned about any of these talk to. If the mortgage rate in this example was fixed for the length of the 30-year term youd pay 360. Calculate what you can afford and more.

Find out how much you could borrow. This mortgage calculator will show how much you can afford. For this reason our calculator uses your.

Use our mortgage calculator to see how much you may be able to borrow with a NatWest mortgage our mortgage rates and what. Why Borrow More On Your Mortgage. Lenders will typically use an income multiple of 4-45 times salary per person.

Borrow amounts starting from 10000. Before you invest 200k into a home youll want to be. Ideal for bigger purchases from home improvements to.

Saving a bigger deposit. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. How much can I borrow.

Well still assume a nominal boarding fee of 150week. Your salary will have a big impact on the amount you can borrow for a mortgage. 7800 yearly boarding fee.

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. This mortgage calculation analyses the amount you and your partner earn each year and provides a benchmark amount that you could expect to borrow from a mortgage lender. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. This is a percentage that shows the split between your mortgage and the loan amount after youve paid your. A big part of the mortgage application is your loan to value ratio or LTV.

Mortgage amount 200000. Mortgage term 30 years. If youre not careful borrowing a small amount could be more expensive than taking out a big loan.

For example if you earn 30000 a year you may be able to borrow anywhere between 120000. The first step in buying a house is determining your budget. Fill in the entry fields.

How much money can u borrow for a mortgage Kamis 01 September 2022 Edit. Were not including additional liabilities in estimating the income. How much you can afford to borrow depends on your deposit your income your credit history and the value of the property itself.

This mortgage calculator will show how. Pay it back over a longer period of time. Even when youre looking for a small mortgage the details still matter.

Free 27 Printable Client Information Sheet Templates Real Estate Forms Real Estate Client Real Estate Tips

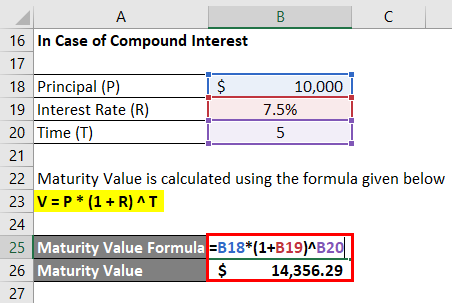

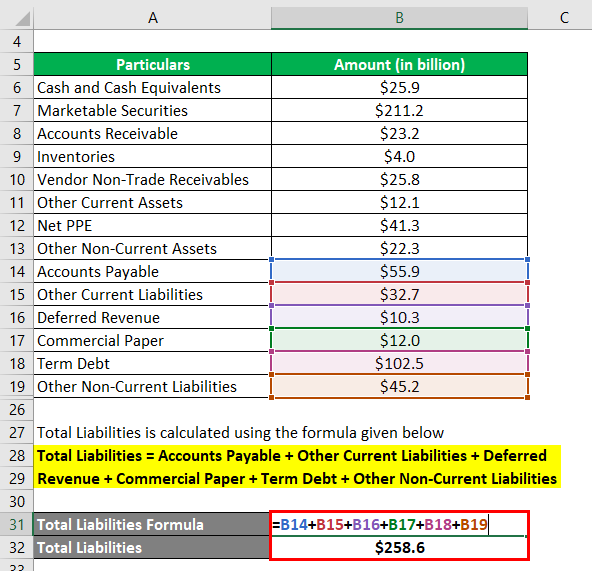

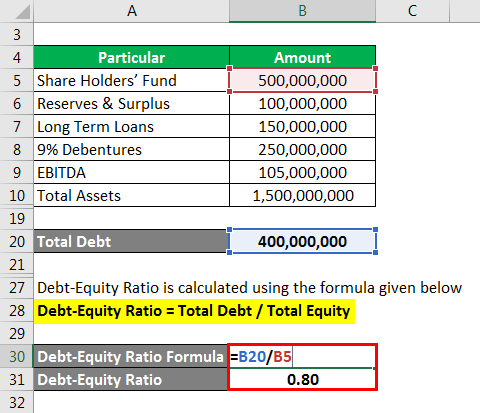

Leverage Ratio Explanation Types And Example

Slide Iay1pobtooe Jpg

Pin On Catholic Practices

Stran Company Inc Ipo Investment Prospectus S 1 A

Debt To Income Ratio Formula Calculator Excel Template

27 Loan Contract Templates Word Google Docs Apple Pages Free Premium Templates

27 Loan Contract Templates Word Google Docs Apple Pages Free Premium Templates

Maturity Value Formula Calculator Excel Template

Net Worth Formula Calculator Examples With Excel Template

27 Best Swot Analysis Templates Excel Word Pdf Best Collections Swot Analysis Template Swot Analysis Analysis

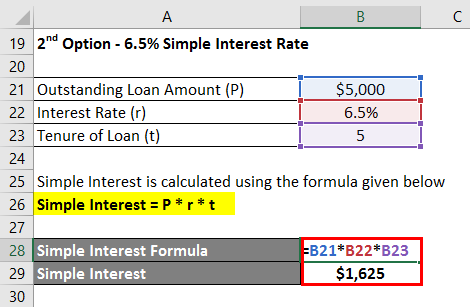

Interest Formula Calculator Examples With Excel Template

013 Free Printable Checks Template Of Editable Blank Check Inside Customizable Blank Check Template Printable Checks Templates Printable Free Blank Check

27 Cover Letter For Graduate School School Template Resume Cover Letter Examples Letter Of Recommendation

Net Worth Formula Calculator Examples With Excel Template

Leverage Ratio Explanation Types And Example

The Best 27 Passive Income Ideas For 2022 Money Life Wax